Middleby’s Residential Kitchen business has been posting pretty lackluster results recently. They point to a mixture of consumer sentiment from macroeconomic factors and still too much inventory at retail. According to an investor presentation though, they believe improvements are on the horizon.

Their Residential Kitchen business encompasses quite a few brands, from the ultra-premium Viking to all their outdoor brands like Masterbuilt, Kamado Joe, and Char-Griller. One theme that’s true for all the brands is a decrease in discretionary spending is going hurt them. Another is that there is a correlation with home sales.

Home Sales and Grill Sales

It’s easy to see a link between Middleby’s indoor Residential Kitchen brands and new home builds. A new house needs a kitchen, and for high-end homes they’ll often turn to one of their brands. Even existing home sales likely has an impact when you factor in that new home owners often renovate.

That correlation also spills into the backyard. When people buy a home, new or existing, another purchase they often make is a grill. It’s why in market sizing the grill market the top of the funnel starts with the number of homes.

Home Sales Bottom

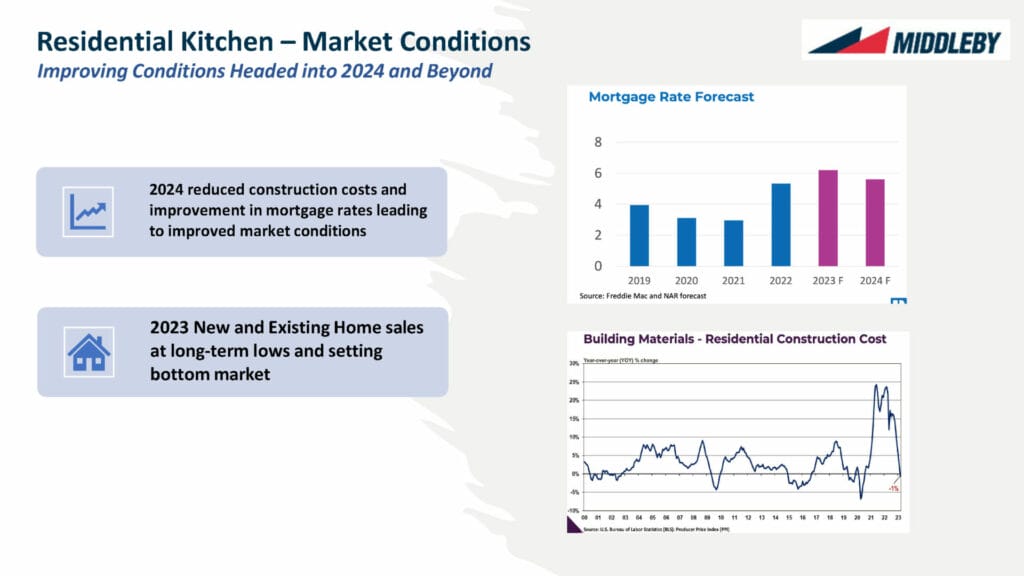

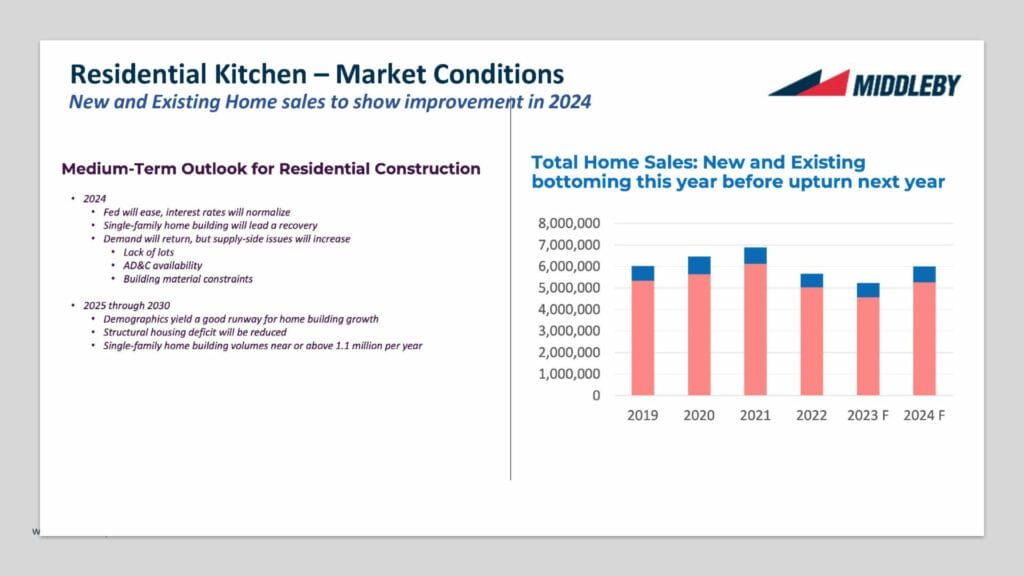

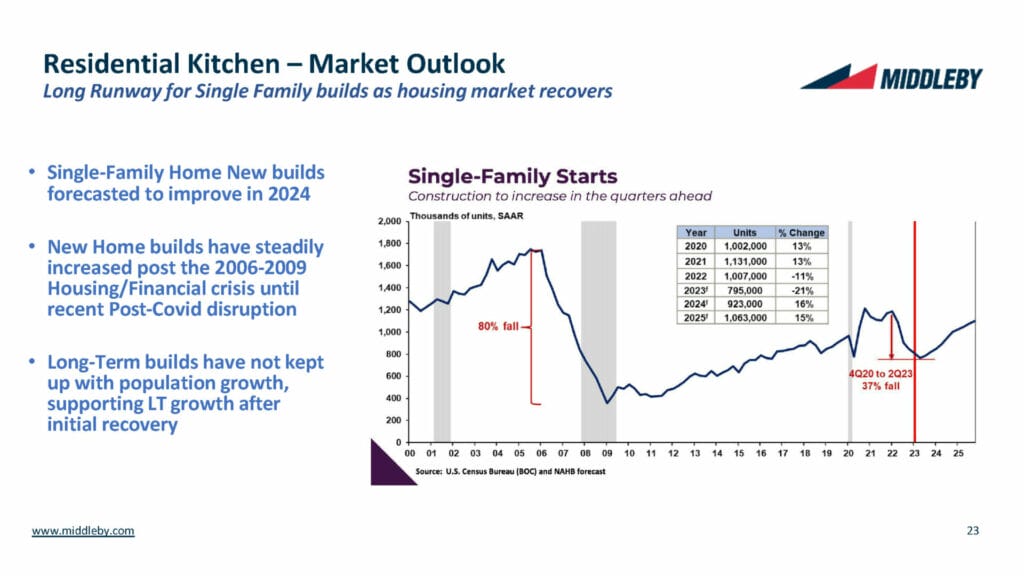

Middleby believes that 2023 is a bottom for home sales when analyzing a variety of sources. Below are some slides from their investor materials that explains their thinking.

I think Middleby has sound logic on there being a housing recovery in the near future. The main question mark is around timing of the recovery. It’s so dependent on what the Fed does with interest rates, which is directly tied to inflation.

Tying it back to grill sales, I agree with Middleby that 2024 will be a transitional year showing some improvements. We’ll see how much that bleeds into 2025 before we get back to normal market conditions.