Gozney reported stub financials for 2024 that show that they continue to grow revenue. Their fiscal year has always been through March 31st, but they did an additional audit on the remaining nine months of 2024.

It’s not clear why they did an additional audit, but it could be as simple as they wanted to switch their fiscal calendar to match the calendar year. It could also be prompted by their recent equity raises either to match that of the investors or to provide current data.

Financial Look

Although their recent financials are only for the last nine months of 2024, they’re easily on-track to keep growing the business. Using today’s conversion of $1.33 for every GBP, they hit $80.7 million for the year ended March 31st, compared to $75.3 million in revenue for the last nine months of the year.

Performance was underpinned by the Group’s continued international expansion. Growth in wholesale channels, combined with increased brand recognition, supported demand across key markets. The successful launch of new, innovative products at the end of the prior reporting period further enhanced the Group’s market position and reinforced its reputation for delivering premium outdoor cooking solutions.

The Group continued to prioritise investment in research and product development, ensuring a strong pipeline of pioneering, high-quality products to drive sustainable growth in the years ahead.

The year marked only the Group’s third year of trading through wholesale channels in its key markets. As expected, the Group continued to establish and strengthen relationships with leading retail partners, driving substantial growth within the wholesale channel while complementing strong direct-to-consumer sales.

Looking ahead, the leadership team remains confident that continued investment in localised sales teams will deepen these retail partnerships and support optimal channel balance. By strategically managing growth across both wholesale and direct-to-consumer channels, the Group aims to maximise revenue opportunities, broaden brand visibility, and maintain a resilient and sustainable business model across its global markets

Gozney

Despite increasing their retail partnerships, they’ve managed to mostly preserve their gross margin. They’re down a point to 33% from 34% through March of 2024. This is obviously before the US tariffs came into effect in 2025.

The slight decrease reflects wholesale deductions associated with expanded retail partnerships. Investments in product quality, direct oversight of manufacturing, wholesale marketing partnerships, and expanded production capacity are expected to collectively enhance performance in the future.

Gozney

Much like their year ended in March, they were essentially flat on operating profit, with a small loss of $363k.

Employees

To go along with growing revenue, Gozney grew headcount through the balance of 2024. They had 101 employees in March and that number increased to 113 by the end of December. The largest functional area for hiring was marketing that went from 18 to 25 employees.

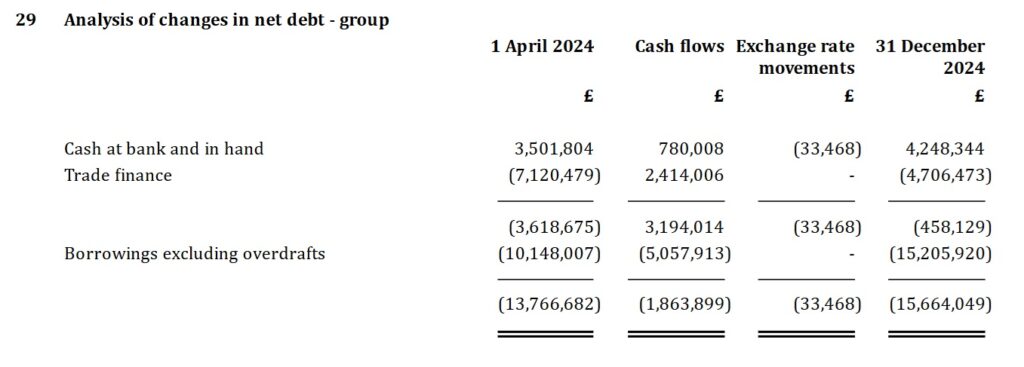

Debt

Gozney has been fueling their growth with a combination of equity and debt. Their debt balance has continued to grow through 2024.